BUSINESS OWNERS & ENTREPRENEURS

$50K+ TO $250K AT 0% APR

FUNDING FOR YOUR BUSINESS

With a Guaranteed Funding Strategy, running your business becomes effortless, because you have a cash flow that works FOR you and not against you.

FILL OUT YOUR INFO & BOOK A CALL

Check Our Client Results:

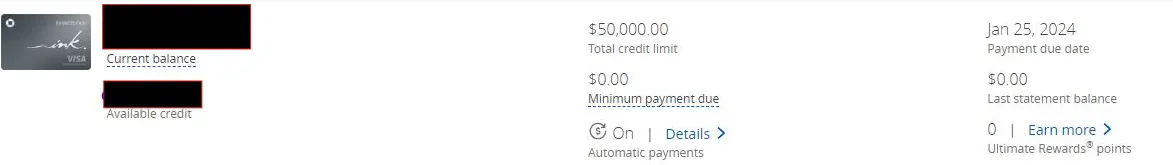

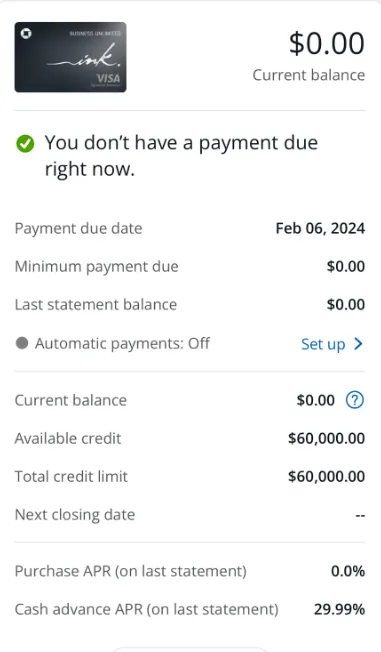

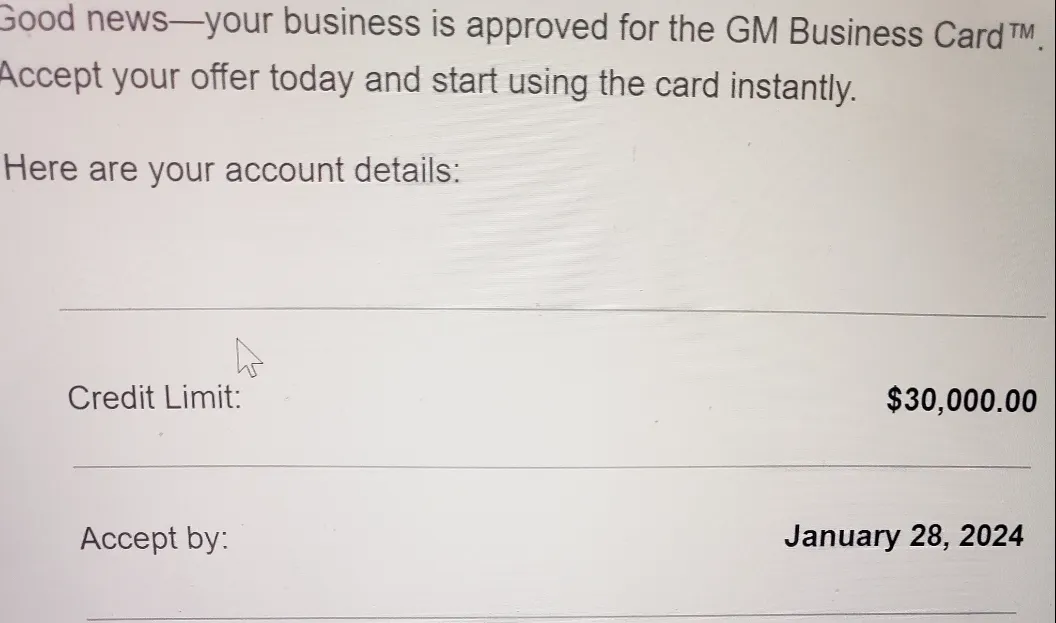

Dylan Mitchell

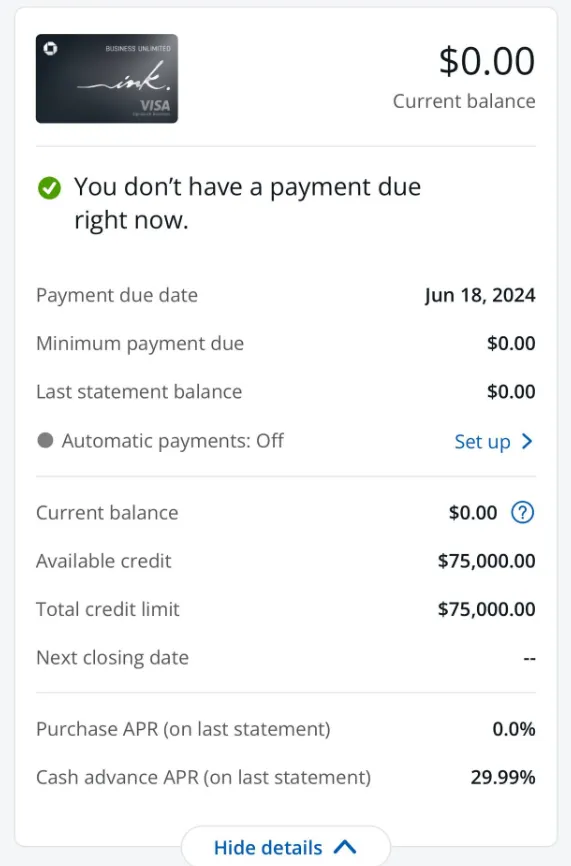

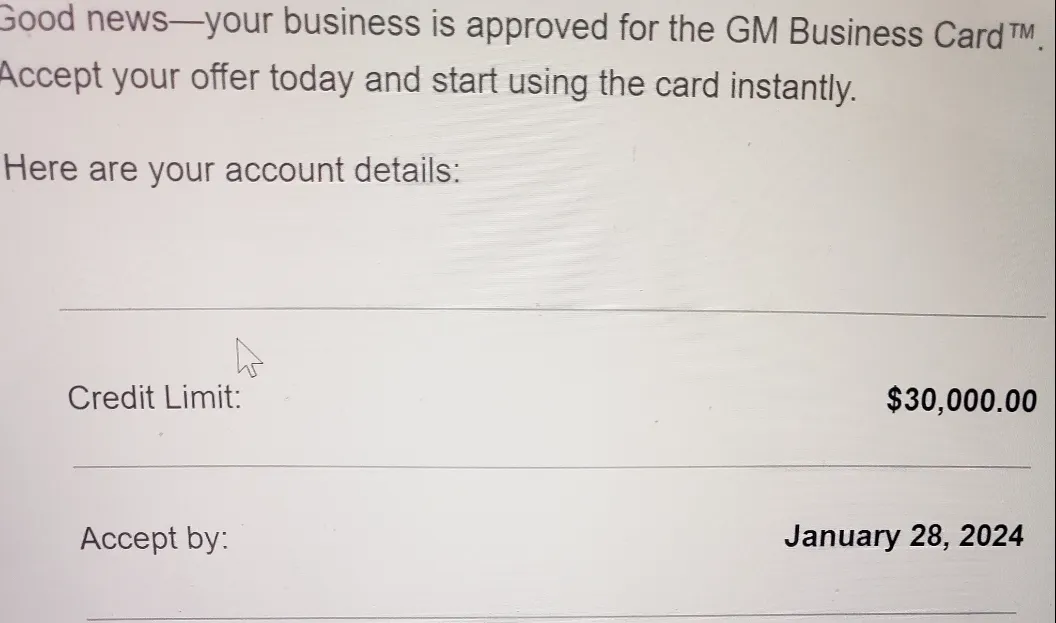

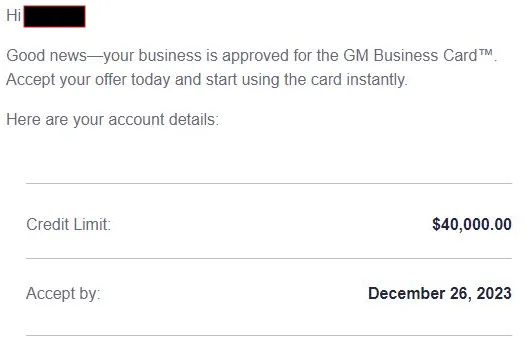

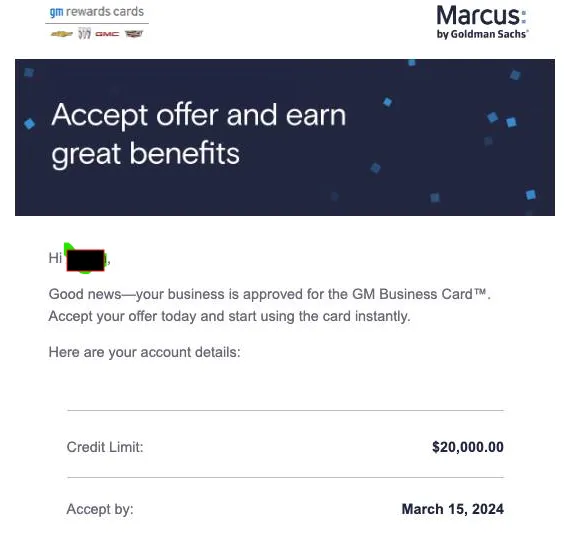

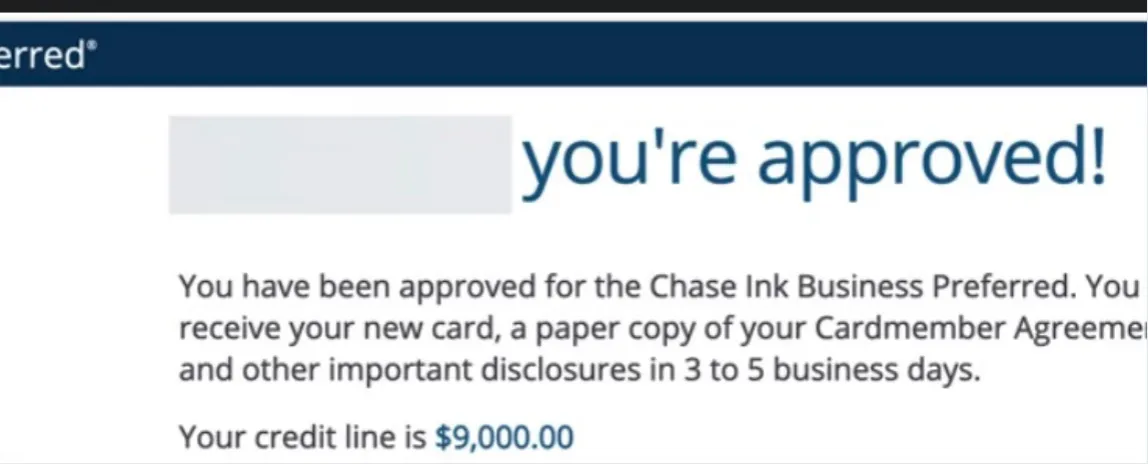

Victor Santiago

Niche: Real Estate

Result: $85,000 in 34 days

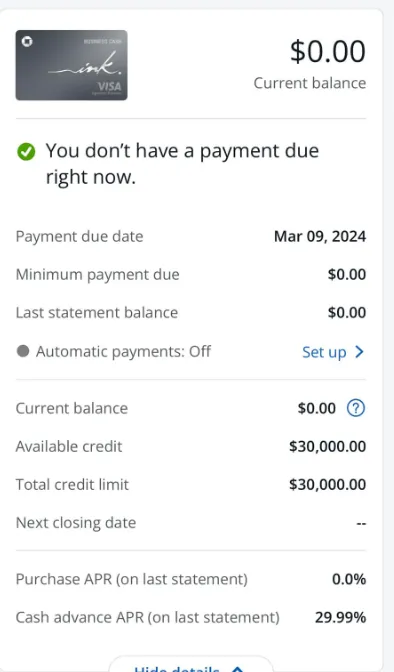

Victor Santiago: Victor was able to secure a $85k with 0% APR in 34 days with a brand new LLC

Victor always wanted to enter the world of real estate rental, but he was struggling due to the lack of capital to take action. He didn't even know business credit was an option to build his real estate portfolio.

The Process

When we first started working with Victor we guided him step by step on how to create and structure his LLC properly and also the correct banks to build relationships with to maximize his approval odds. so finally successfully applied for business credit cards.

The Result

We were able to fund him with a $85,000 of 0% APR business credit card even with a new LLC. Victor was able to add 2 studios in his current home (now he is living for free) and he just purchased his second rental property bringing him in total of $72,000 passively income every year.

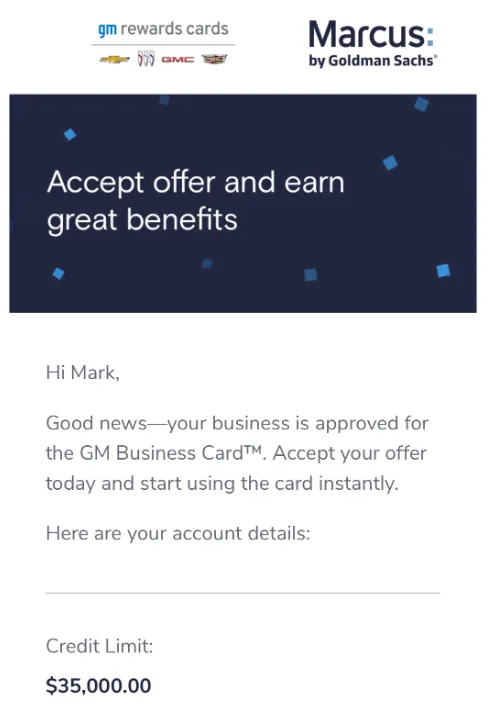

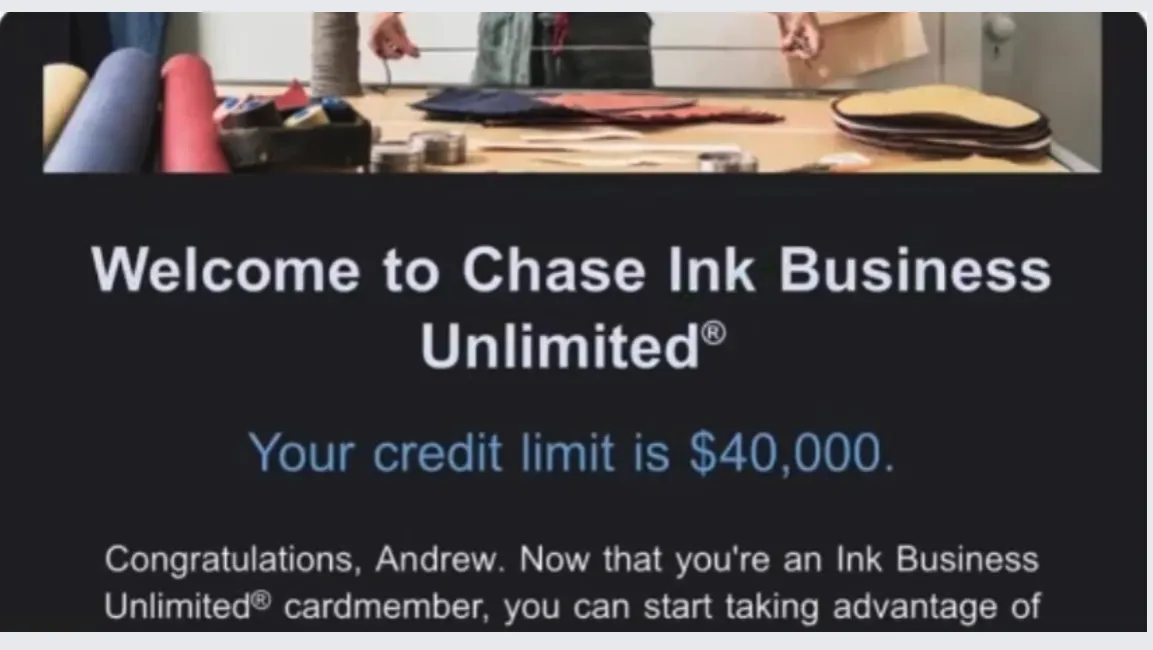

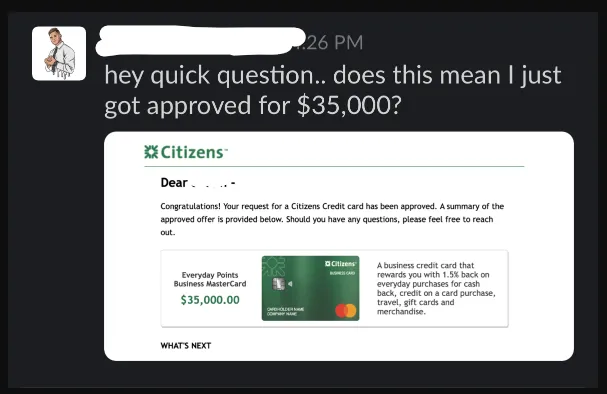

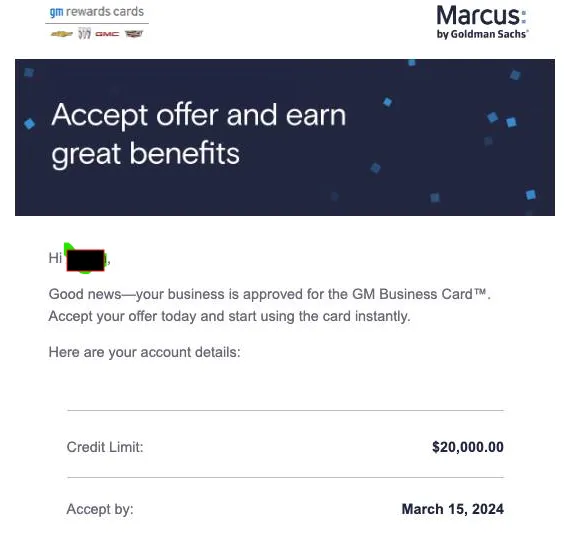

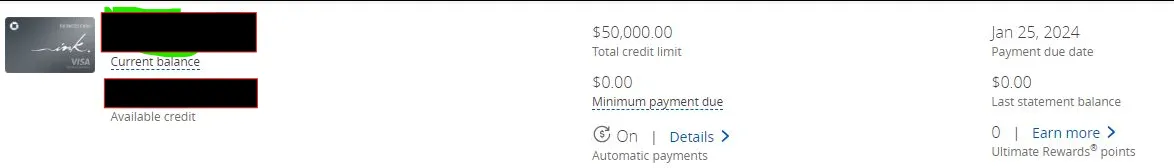

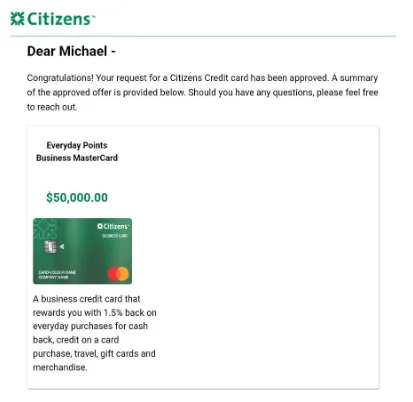

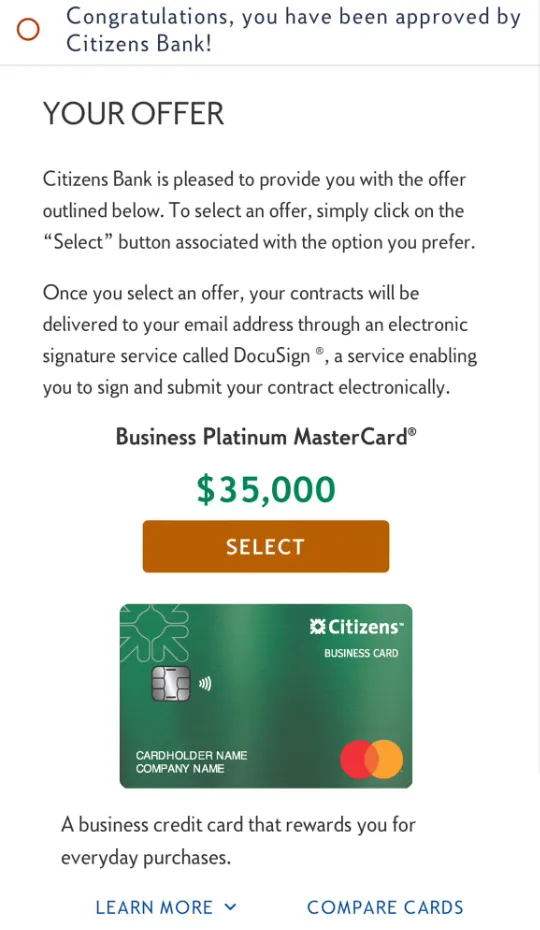

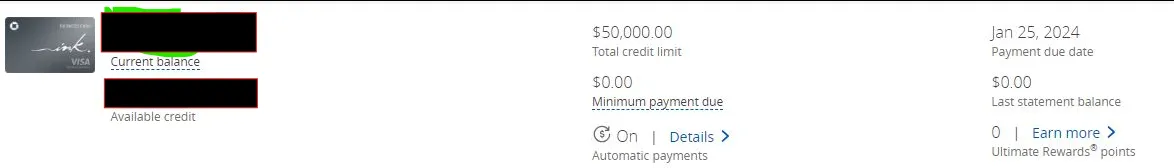

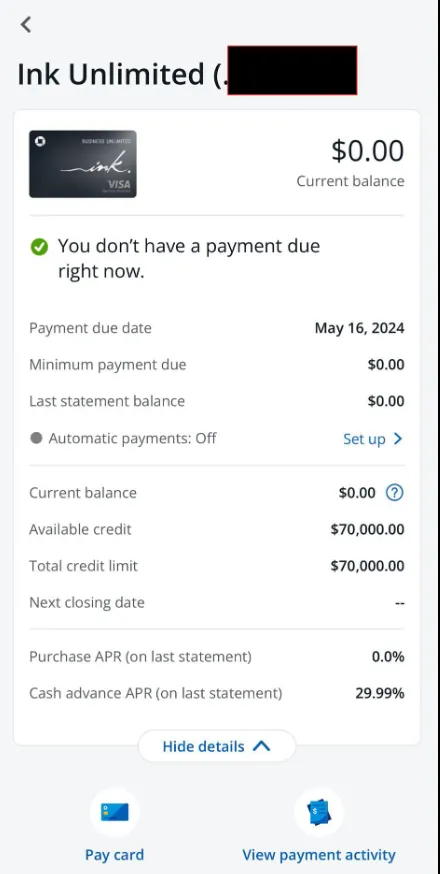

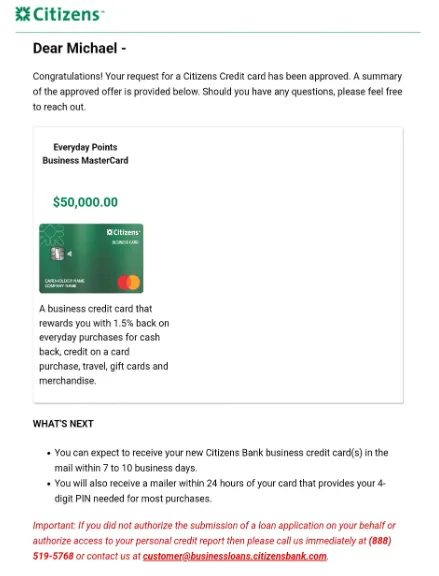

Michael Gazzi

AI Intercomp

Niche: Software AI

Result: $120,000 in 3 weeks

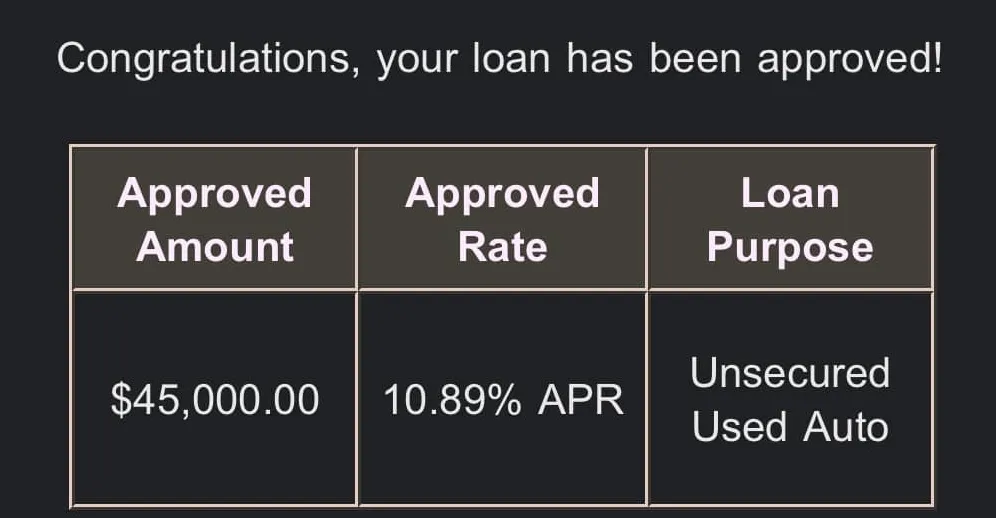

Credit Gentlemen: Michael was able to secure a $120k with 0% APR in just 6 weeks of working with us.

Michael encountered difficulties raising money from private investors due to no track record in his company . He conducted multiple call with investors to obtain the capital to start his business but no results and was unaware that business credit could be a viable solution, since early stage his transactions exclusively in cash, which constrained the potential growth of his company.

The Process

Upon our initial collaboration with Michael, we offered detailed guidance to enhance his personal credit profile and enhance his chances of higher approval. This involved incorporating authorized users to fortify his credit history, introducing additional accounts for credit mix diversification, and successfully acquiring business credit cards.

The Result

Our efforts yielded success, securing him a $120,000 business credit card with a 0% APR.As a result, Michael had the capital to move faster and is looking to growth more his company.

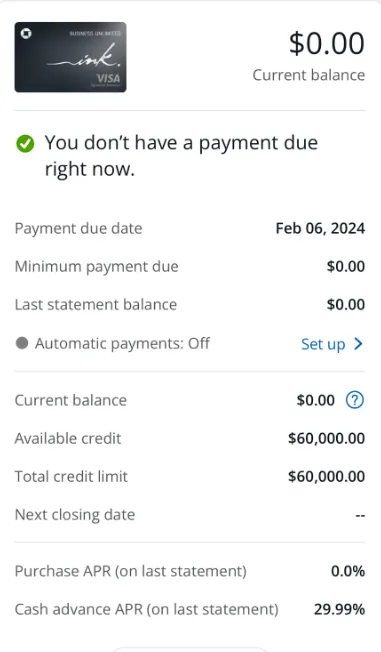

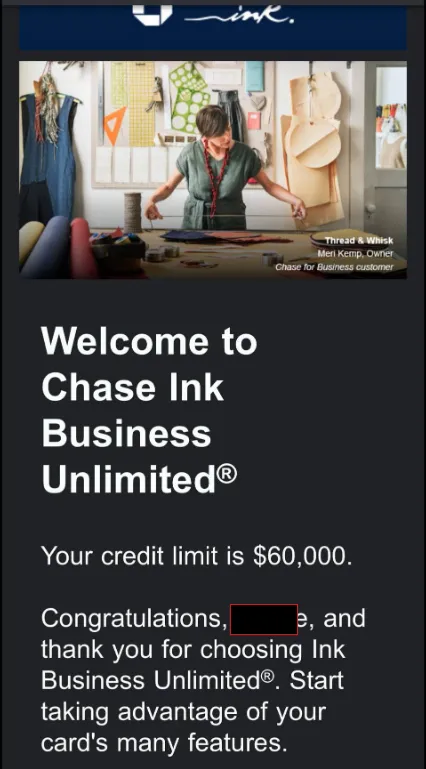

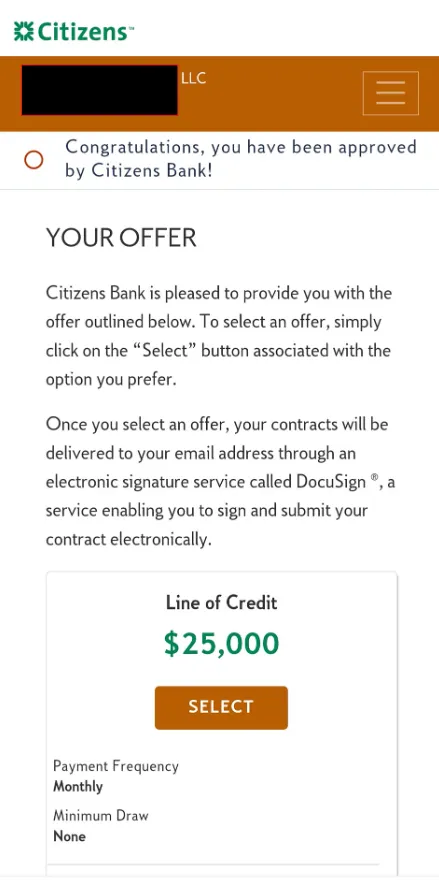

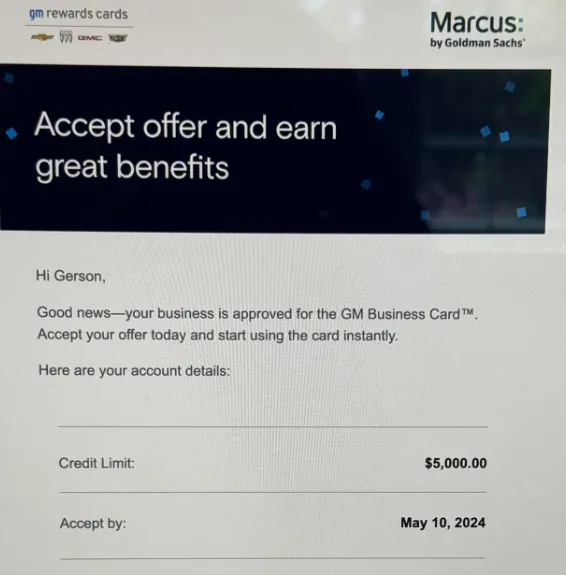

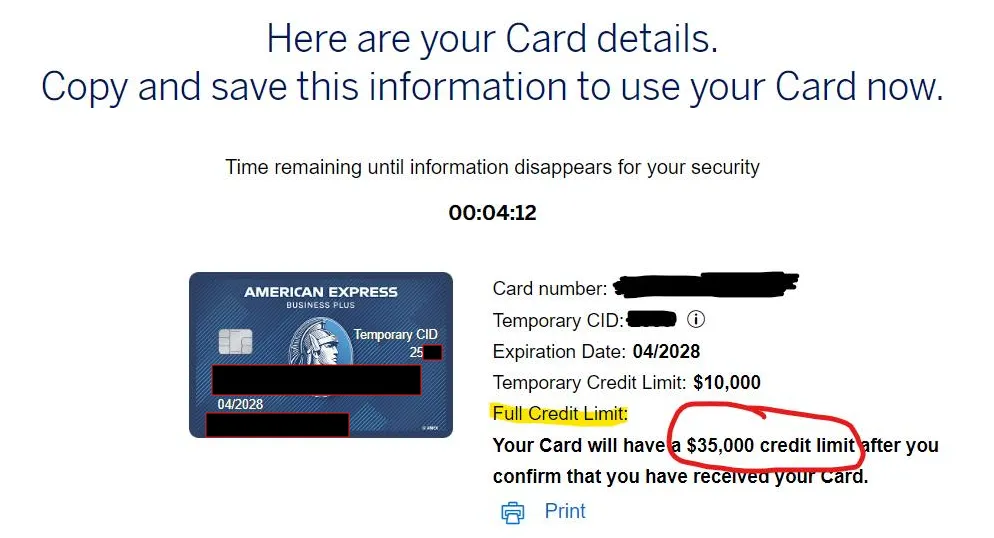

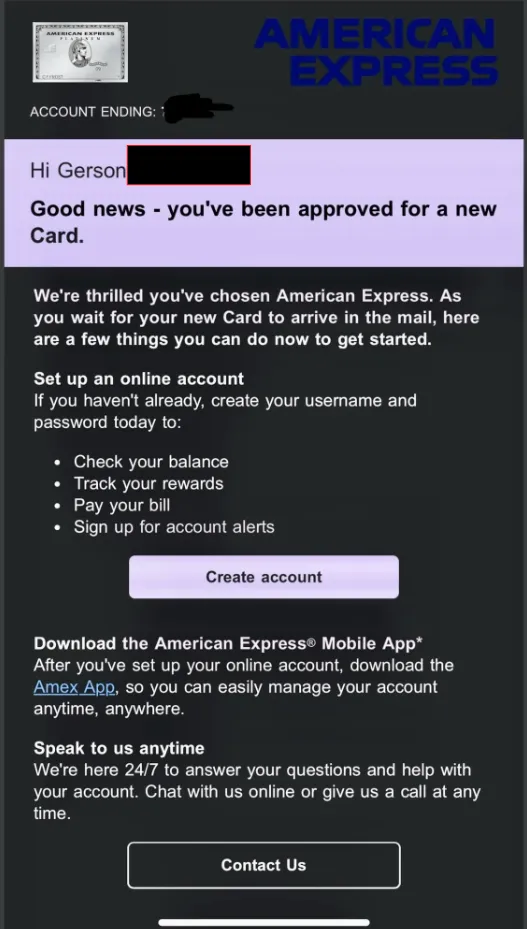

Gerson Lopez

Niche: HVAC Company

Result: $100,000 in 60 Days

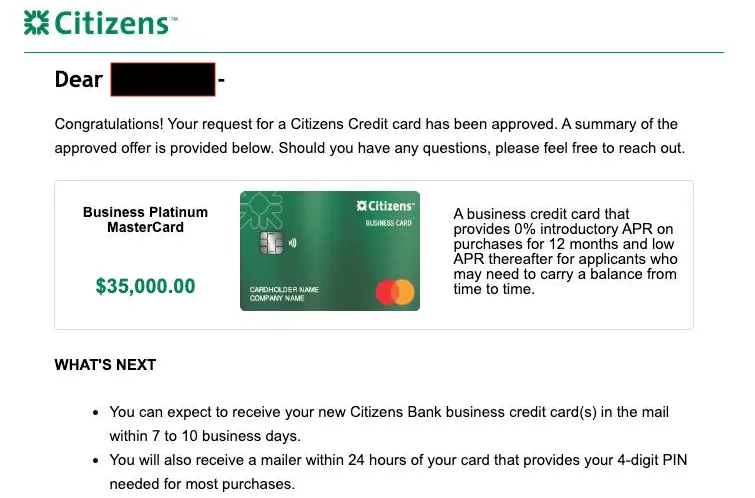

TEMPCOLD HVAC: Gerson was able to secure $100k with 0% APR in just 60 days.

Gerson was using her own personal savings to finance her HVAC business. Whenever there is a need for repairs and inventory purchase, she relies solely on his business savings and this limits him from expanding his business.

The Process

During our initial call with Gerson, she just want funding for her business without maxing out her personal savings. We checked her financial standing and formulated an effective game plan.

The Result

Thanks to this financial uplift, Gerson now has the ability to employ a credit card for her day-to-day expenses. This not only facilitates the accumulation of reward points and cashback but also affords her the flexibility to promote her product without the burden of immediate cash outflow.

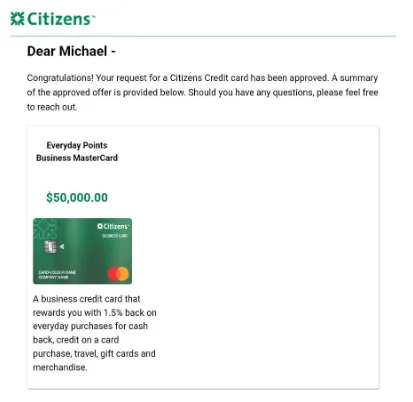

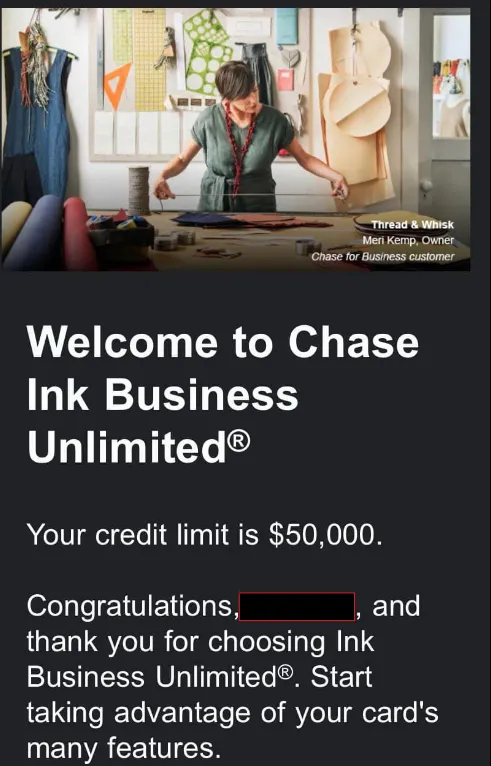

Jennifer Wallen

BEAUTY SALON

Niche: Med Spa

Result: $90,000 in 3 weeks

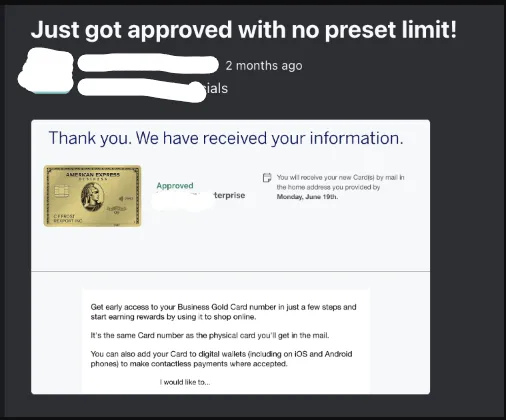

MEDBEAUTY: Jennifer Went From $0 to $90k in fundings in just 7 weeks

When Jennifer approached us about MedBeauty, she had been diving deep into her personal reserves, occasionally draining her own savings to acquire fresh stock for her beauty venture. Jennifer recognized that if she continued down this path, her aspirations of expanding her business would remain just dreams.

The Process

Upon initiation, Jennifer's sole request was, "I just need funding to manage the initial expenses without depleting my own account." She was confident about scheduling client bookings and generating enough revenue for repayment. But, she desired to break free from the cycle of risking her personal savings.

MedBeauty thoroughly assessed her financial standing and devised a comprehensive strategy tailored for her. Subsequently, Jennifer received approvals for a combined amount of $90,000 across 4 credit cards.

The Result

Thanks to this financial boost, Jennifer could now utilize a credit card for her routine expenditures. This not only enabled her to accrue reward points and cashback but also provided her the flexibility to market her products without the stress of immediate cash outflow.

PEOPLE APPROVALS, YOU CAN BE NEXT!